Northwest Bank Provides Aid to More Than 1,200 Small Businesses Through the Paycheck Protection Program

posted

on Wednesday, April 29, 2020

in

Business

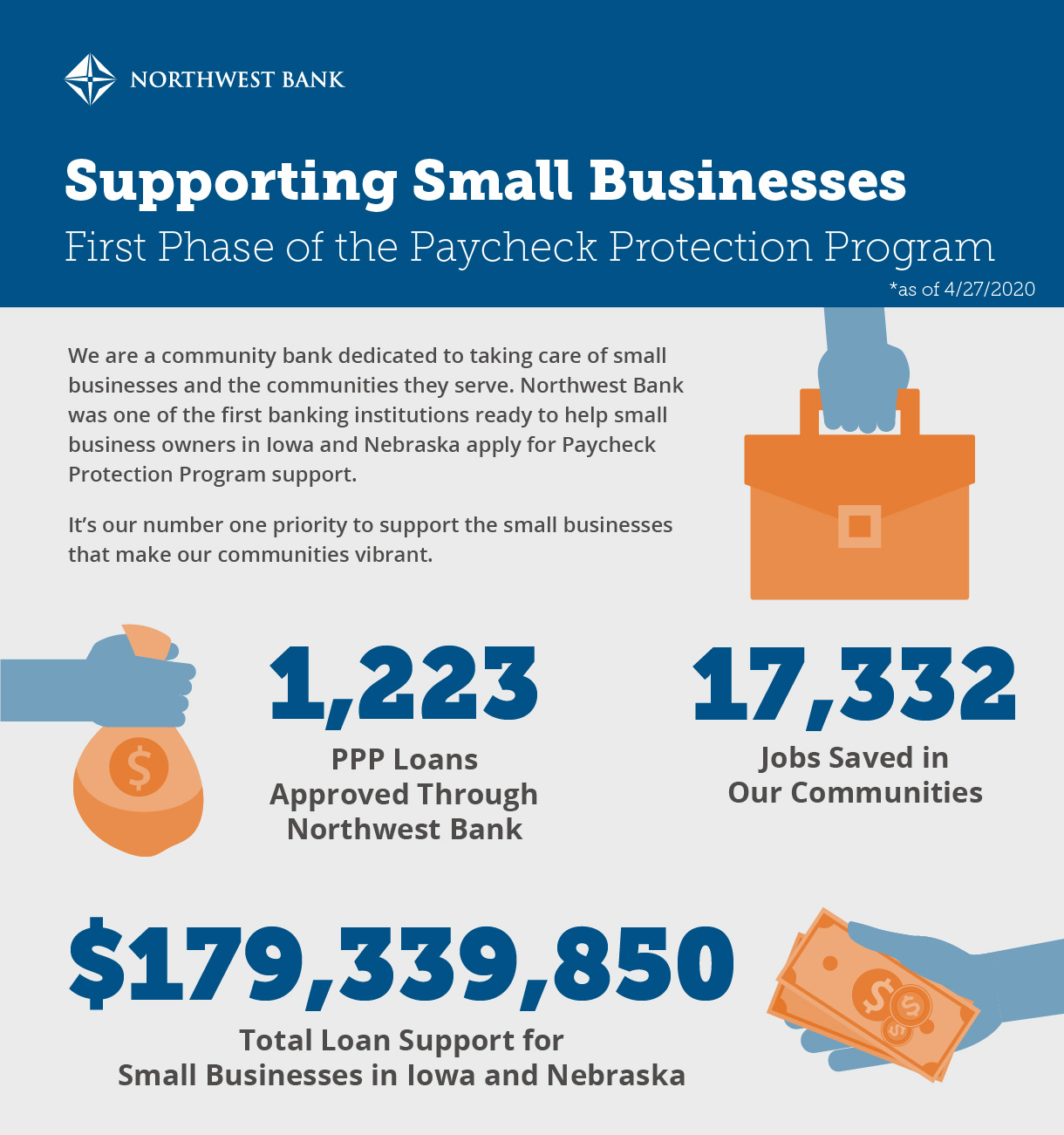

When the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) began on Friday, April 3, community banks immediately answered the call to provide aid to small businesses. Northwest Bank was ready on day one, submitting more than 100 PPP loan applications.

“When the Paycheck Protection Program became available, our bankers got to work right away, submitting hundreds of loans that helped thousands of people in Iowa and Nebraska keep their jobs,” said Joe Conover, President, Northwest Bank. “The small business community is hurting right now, and I’m proud of the commitment our bank has to helping main street businesses during this challenging time.”

Since the program launched, Northwest Bank has issued loans to more than 1,200 small businesses for a total of nearly $190 million. In addition, 91% of the PPP loans submitted by Northwest Bank were for loan requests of $350,000 or less. This has helped small businesses continue paying more than 17,000 employees in the communities Northwest Bank serves.

“Many of our customers are living their lifelong dream of owning their own business, and we want to make sure that dream isn’t taken away from them,” Conover said. “Because when small businesses succeed, our communities and families succeed too.”

The PPP was announced by the SBA in early April and offered forgivable loans to small businesses through their local banks as an incentive to keep their employees on payroll during the pandemic, even as they make drastic changes to their business models. Since the coronavirus first appeared in the United States, businesses have been forced to start offering curbside pickup for a wide variety of products, drive-up grocery service, and carry-out and delivery food service at restaurants.

The program’s initial funding of $349 billion ran out on April 16. The second round of federal stimulus funding was approved on Friday, April 24, adding an additional $320 billion to the PPP. Northwest Bank will continue to provide guidance and PPP loan support to small business owners on the application and submission process and the appropriate use of their funds so that eligible small businesses can turn their loans into grants.