Don't Let Your Credit Score Fall

posted

on Friday, November 20, 2020

in

Education

Multiple factors influence your credit score. Understand the amount of influence each action has on your score.

- 40% Payment History

- 23% Credit Usage

- 21% Credit Age

- 11% Mix of Credit

- 5% Recent Credit

Payment History

Pay down your credit balance in full and on time every time. Usually your payments are due once a month.

Credit Usage

Only spend 10% - 30% of all your available credit -- yes this means across all lines of credit you have and on each line individually. The more debt you pay off, the higher that score will climb.

Recent Credit

Every time you request a new line of credit, a hard inquiry is placed on your credit, which makes the score go down a little bit, it falls off your report after 2 years, but try not to apply for too many lines of credit at the same time if you're trying to raise your score.

If your score did fall... Here are some solutions!

- Set a monthly reminder on your calendar to pay your bill if you constantly forget. Or, better yet, set up automatic payments.

- If you are spending too much of your available credit, request a credit limit increase, but be sure to keep your spending where it is so the ratio improves.

- Do not apply for too many loans or credit cards at once. Spread out any requests over time.

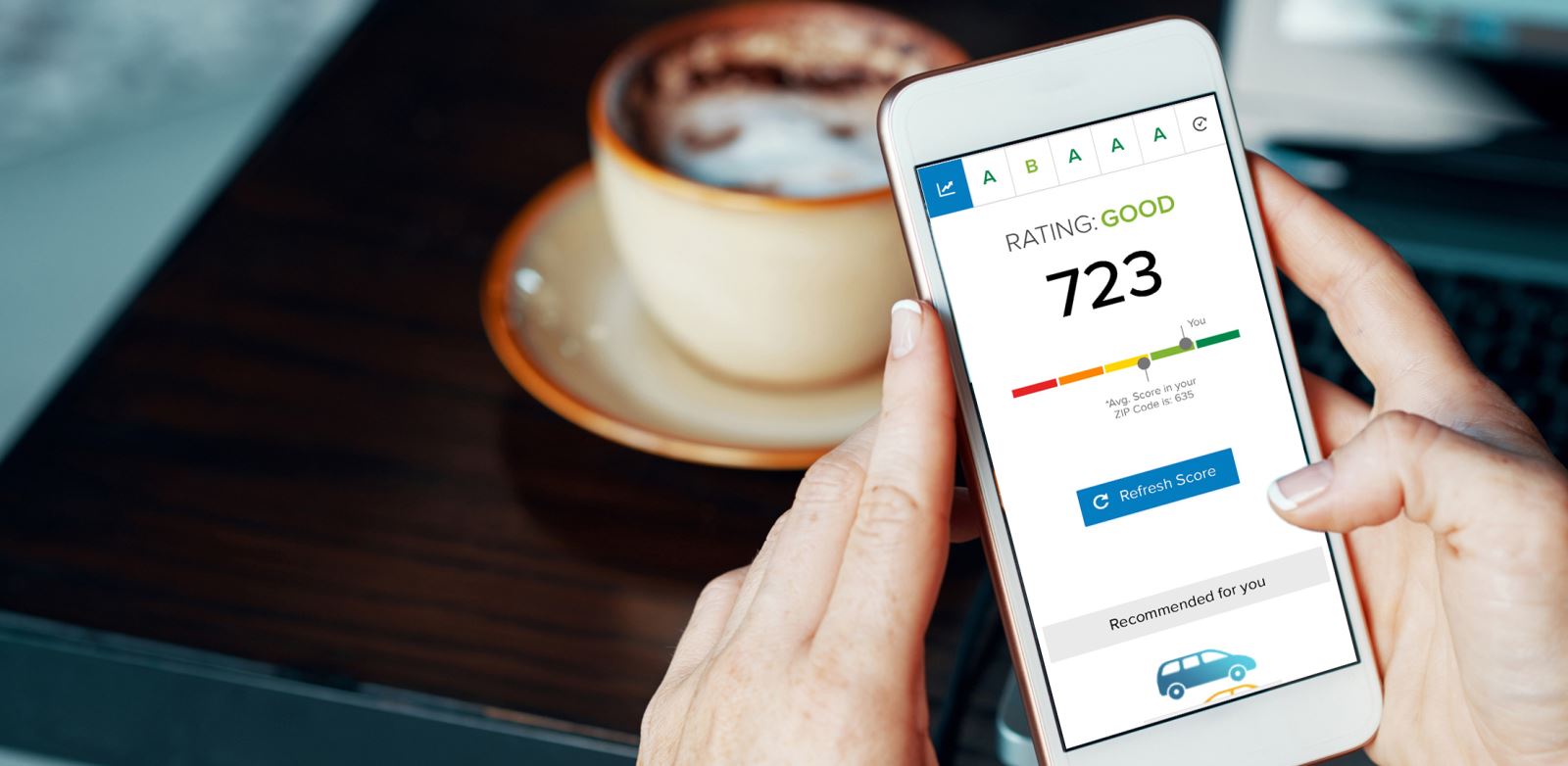

Protect and Manage Your Credit with Credit Sense.

You can access your credit score* along with personalized tips on how to improve or maintain an already great score with Credit Sense. It's built right into your Online and Mobile Banking App, so you won't need a new login.

*Know Your Score Today!

To learn more ways to manage your finances, complete this form and a Personal Banker will be in contact with you!